Master AGA GAFRB Exam with Reliable Practice Questions

When determining the full costs of a specific product or service, if the costs cannot be directly traced to the product or service, the costs should be assigned based upon

Correct : D

Start a Discussions

A special-purpose government is considered a primary government when it has any of the following characteristics EXCEPT that it

Correct : A

Start a Discussions

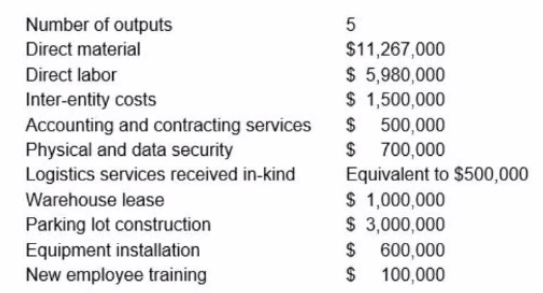

Based on FASAB standards, calculate the full cost of 1 unit of an output using the following information:

Correct : D

Under FASAB standards, specifically SFFAS No. 4, Managerial Cost Accounting Standards, the full cost of an output includes:

Direct costs (e.g., direct material and labor)

Indirect costs (e.g., inter-entity costs, overhead, services)

In-kind contributions

Any support service costs

Depreciation or amortization, if applicable

We will now compute the full cost of all 5 units and then divide by 5 to obtain the cost per unit.

Step 1: List and sum all relevant costs.

Direct Material: $11,267,000

Direct Labor: $5,980,000

Inter-entity Costs: $1,500,000

Accounting and Contracting Services: $500,000

Physical and Data Security: $700,000

In-kind Logistics Services: $500,000

Warehouse Lease: $1,000,000

Parking Lot Construction: $3,000,000

Equipment Installation: $600,000

New Employee Training: $100,000

Total Full Cost =

$11,267,000

$5,980,000

$1,500,000

$500,000

$700,000

$500,000

$1,000,000

$3,000,000

$600,000

$100,000

= $25,147,000

Step 2: Calculate cost per unit (based on 5 outputs):

Cost per unit = $25,147,000 5 = $5,029,400

But the question specifically asks:

''Based on FASAB standards, calculate the full cost of 1 unit of an output...''

So, the correct answer (full cost of all units) is:

Answer : D. $25,147,000

If they had asked for cost per unit, then the answer would be:

= $5,029,400 Option C

Note: Option C is a distractor here and would only be correct if the question specifically asked for per unit cost.

Relevant Standards and Reference:

FASAB Statement of Federal Financial Accounting Standards (SFFAS) No. 4: Managerial Cost Accounting Concepts and Standards

OMB Circular A-136: Financial Reporting Requirements

Treasury Financial Manual (TFM), Volume I, Part 2, Chapter 4700

Therefore, the correct answer to the full cost (not per unit) is:

Answer : D. $25,147,000.

Start a Discussions

In state and local financial audits, material weaknesses must be reported to the

Correct : B

Start a Discussions

According to GAAP, all of the following should be addressed in the MD&A EXCEPT

Correct : C

Start a Discussions